Tariff Fallout

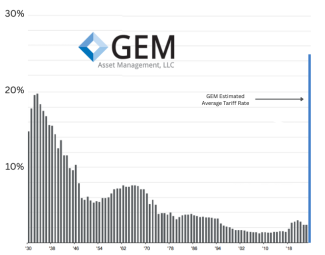

The Big News — This week, President Trump announced a new tariff regime on global imports to the US that were larger than most all observers had anticipated. It’s difficult to aggregate, but our best guess is that the average trade-weighted tariff on goods coming into the country is now at about 25%.

Average US Tariff Rate on Imported Goods

Market Reaction — Ahead of the new tariffs, the S&P 500 declined by about 10% from mid-February through mid-March. In the 2 trading days after the announcement, stocks shed roughly another 10%.In this latest two-day period all sectors declined, however, defensives like Consumer Staples, Utilities and Health Care held up best. Energy fared the worst as oil prices dropped about 14% on concerns of a global economic slowdown.

Economic Outlook — The additional tariffs on imported goods will raise prices for consumers. We are hearing to look for an additional 1% on the core inflation rate. A slowdown in consumption could lead to weakness in employment. While the administration would like to see production move to the US, that would take time. For the next year or so, we would look for very little, to zero growth in the economy.

What will the Fed Do? — The Federal Reserve has a dual mandate to maintain stable prices and stimulate employment. Both charges come under pressure with the new tariffs. The Fed has emphasized that its decisions are data dependent, and we would look for them to key in on jobs numbers to trigger any action on their part. Indeed, part of the weakness on Friday may have been a result of the stronger jobs data which might indicate less of a chance for an interest rate cut soon.

We look at the 2-year US Treasury as a guide to where the Fed may take rates, and it appears the market is looking for a cut. The futures markets are predicting four quarter-point cuts by year-end, looking for the first to come at the June meeting.

Dollar Misbehaving — Conventional wisdom says that with an increase in tariffs, the dollar should increase against other currencies. When a someone purchases a foreign item, they sell dollars to buy the local currency. But since mid-January as talk of tariffs began to heat up, the dollar has cooled. It’s supply and demand. To buy foreign goods you don’t need dollars, so you sell them in exchange for the local currency.

However, the dollar has not reacted to the tariff news as many expected. The take is that the scale of the tariffs is so large that the United States appears more vulnerable to slowdown than the rest of the world. If this dollar weakness holds, it exacerbates the impact of the tariffs on consumers by making it more costly to afford imported goods.

Bottom Line — Fears are running high. The VIX volatility index as well as the put/call ratio have both spiked higher. However, the decline so far is within the average for a peak annual drawdown. Further, the slide brings the S&P 500 forward P/E to a level just about at its ten year average.