No Need to be Tariff-ied

The Big News — The new import tariff regime enacted and then delayed by President Trump has put financial markets into turmoil. The ups-and-downs have heightened concerns among investors. But at this point, we don’t recommend investors make any reactive moves.

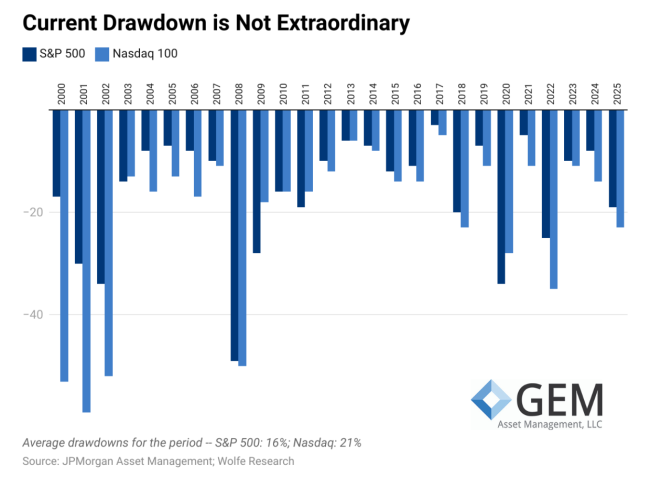

We’ve been here before — The S&P 500 has dropped roughly 19% from its recent high in February. But since 2000, the index has seen double-digit declines 17 times, and the average peak-to-trough slide in that time was about 16%. Volatility in the stock market is natural, and should be built into the expectations of your financial plan.

- Since 1945, the S&P 500 has declined 20% from its peak 12 times. Five years after each decline the index was up every time for an average gain of 53%.

Zoom Out to the Big Picture — Remember, stocks are for the long term. Sudden stock market moves can be shocking as they occur. But the impact of these jolts on a portfolio diminishes as they are averaged over long-term holding period:

- The S&P 500’s trailing 1-year return improved from -2.9% on Tuesday to +6.2% on Wednesday — a difference of 9.1%.

- The trailing 5-year return went from +14.0% on Tuesday to +16.4% on Wednesday — a difference of 2.4%.

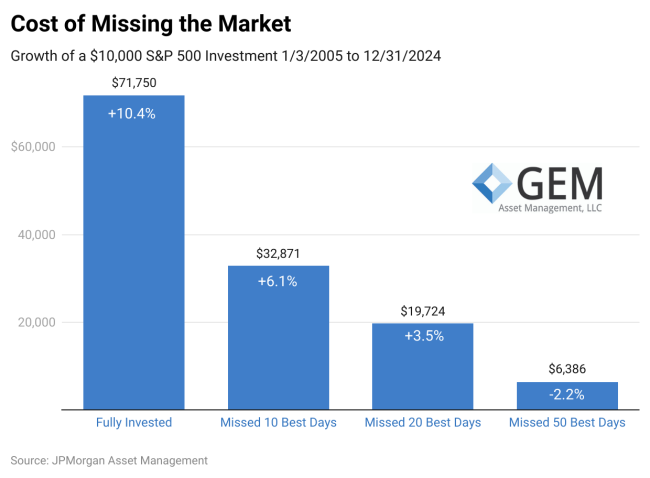

Stay Put & Don’t Miss Out — Within “Bear” markets, stocks can make dramatic moves upward as well as downward.

- In the past 20 years, seven of the 10 best trading days occurred within two weeks of the 10 worst trading days.

- Wednesday’s 12.2% gain in the Nasdaq was its second largest one-day gain ever. The 9.5% jump in the S&P 500 was its third-best day since WWII.

Missing out on the best trading days in the stock market can seriously impair an investor’s long-term returns:

Bottom Line — At this point, we recommend investors hold steady with their investments and not make any reactive moves. Selling within a downturn may just serve to lock in portfolio declines. Your financial plan should incorporate an investment allocation that accounts for this type of volatility and aims to deliver a long-term return that meets your personal financial goals.

If you, or someone you know, is unsettled by the market’s recent performance, feel free to reach out to us.