Is It Time for Bonds?

Investors have traditionally included bonds in their portfolios both as an income producer and as a diversifier that could decrease volatility in their returns over time. The last few years, however, have not been productive for bond investors, but the scenario may be changing.

Recent years have not been typical — The pandemic forced the Federal Reserve to make moves to stimulate the economy. Its goal was to increase the supply of money in the economy and to lower interest rates which would get people borrowing and spending. The Fed did so by entering financial markets and buying massive amounts of bonds. This pushed bond prices up, and in turn, interest rates lower. This added liquidity flowed into stock prices as well. The result for investors was that bonds paid very little interest and their price movements were correlated to stocks.

Bond Yields Up — As we all have noticed in the time since the pandemic, prices of consumer goods have risen. The Fed raised interest rates to combat inflation and yields rose as investors demanded more return to compensate for the declining value of the dollar. JPMorgan (above) has noted that the current yield for the Aggregate Bond Index is a good estimator of the returns an investor could anticipate over the next 5 years. As of month-end that model suggested a return in bonds of about 4.6%-4.7% for the next five years.

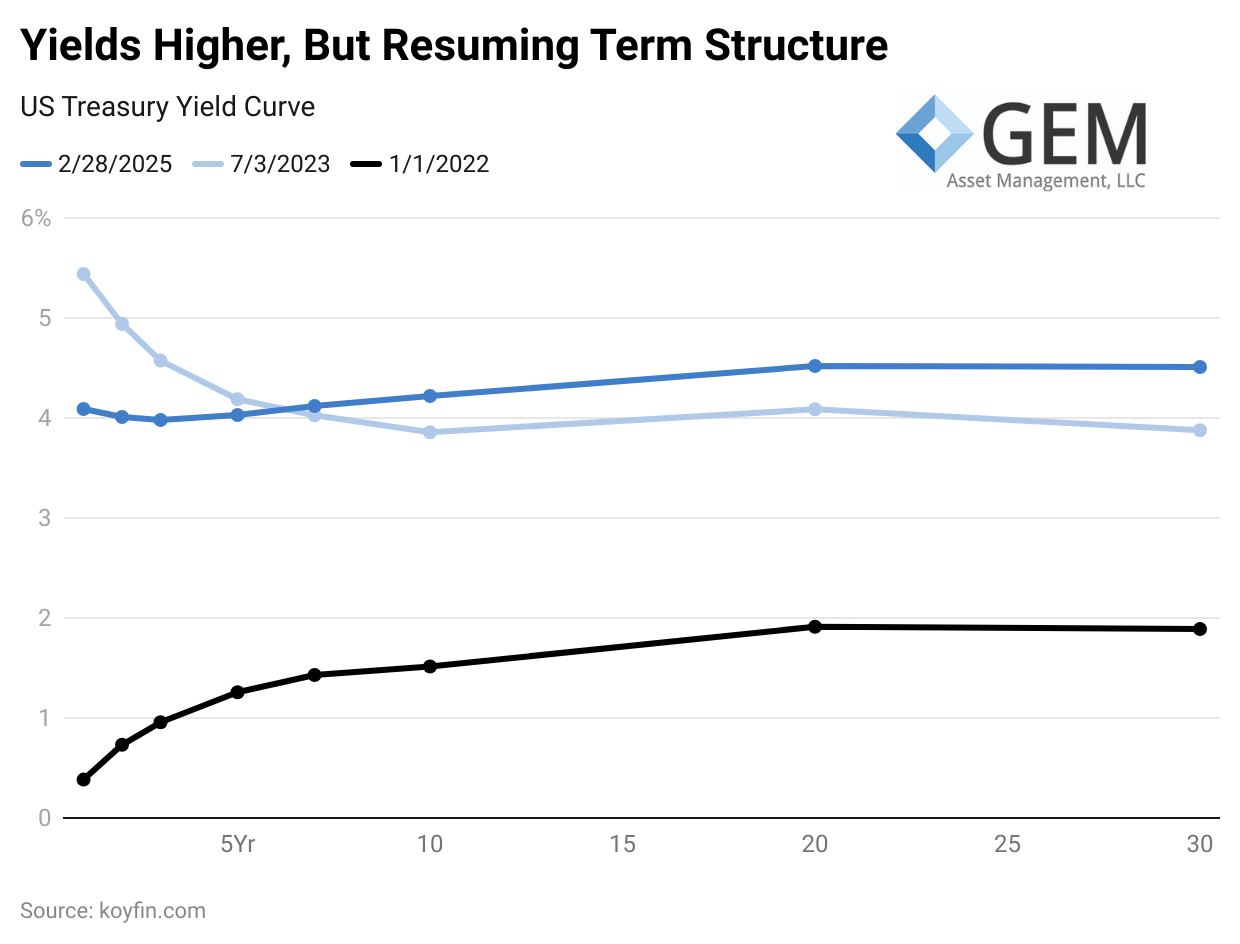

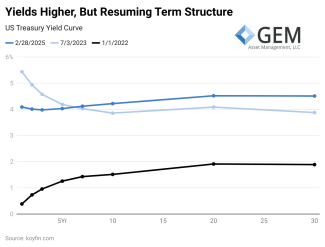

Short Term Yields Relatively Higher — Normally, yields are higher on bonds with longer maturities. Typically those bonds would have more price volatility and there is more time for events that could alter credit risk. Currently, the curve is flattish and doesn’t offer much additional yield for the risk found in longer maturities.

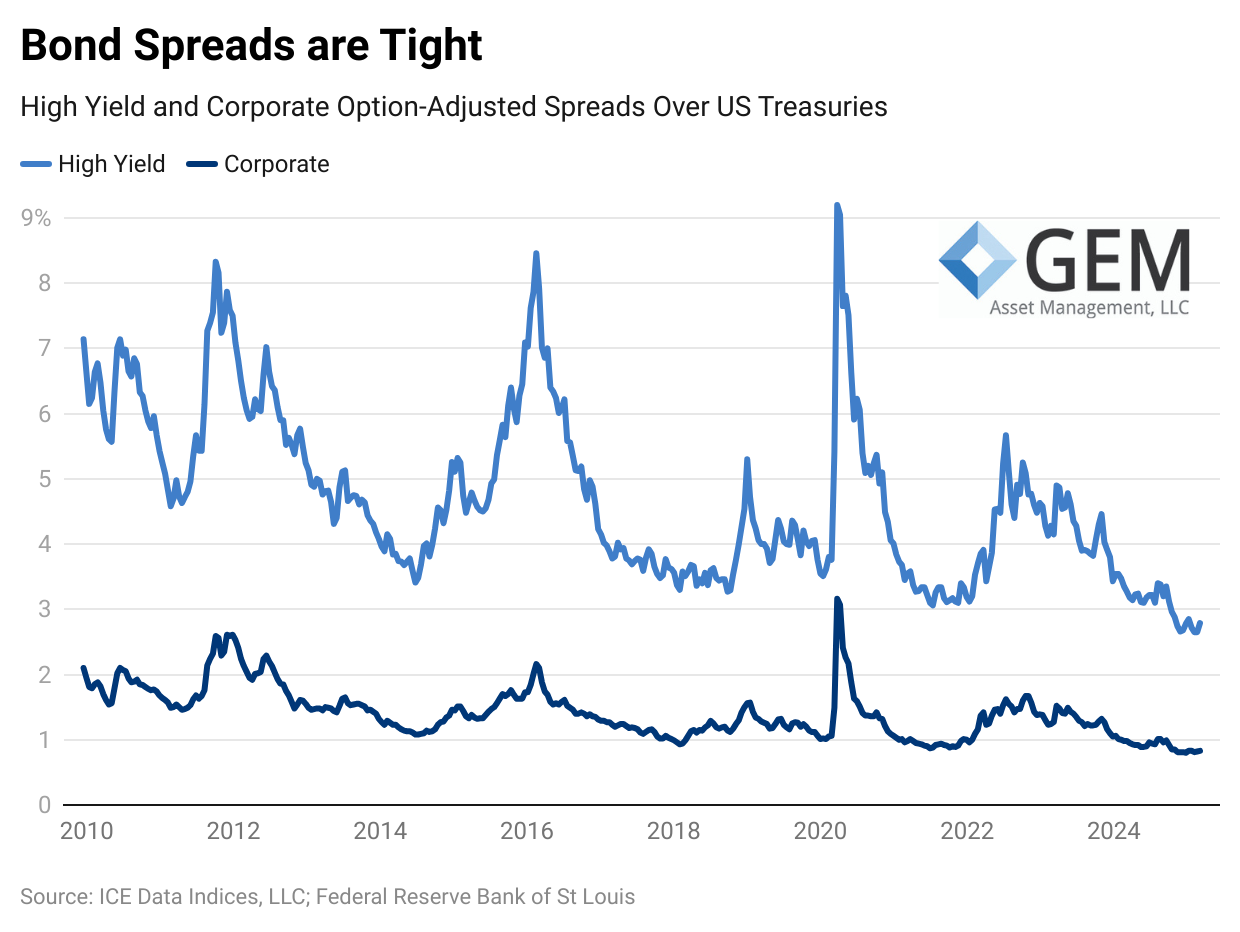

No Premium for Credit Risk - Another place to earn additional return is by investing in stocks of lower quality. Yields on Corporate and High Yield bonds are measured against US Treasuries. At this point the premium in yields for investing in these types of bonds is lower than typically seen in the past — under 1% for Corporate bonds and less than 3% for High Yield bonds.

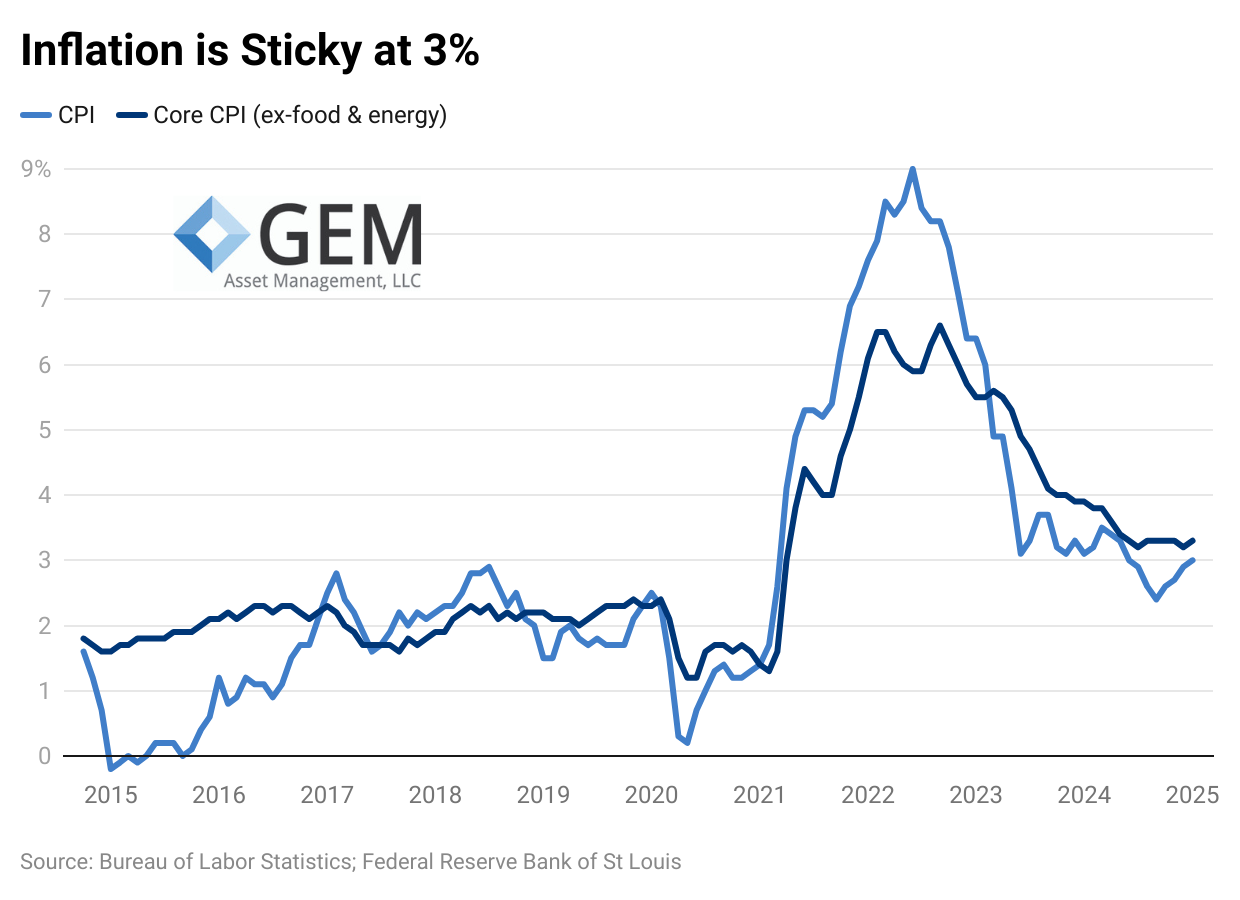

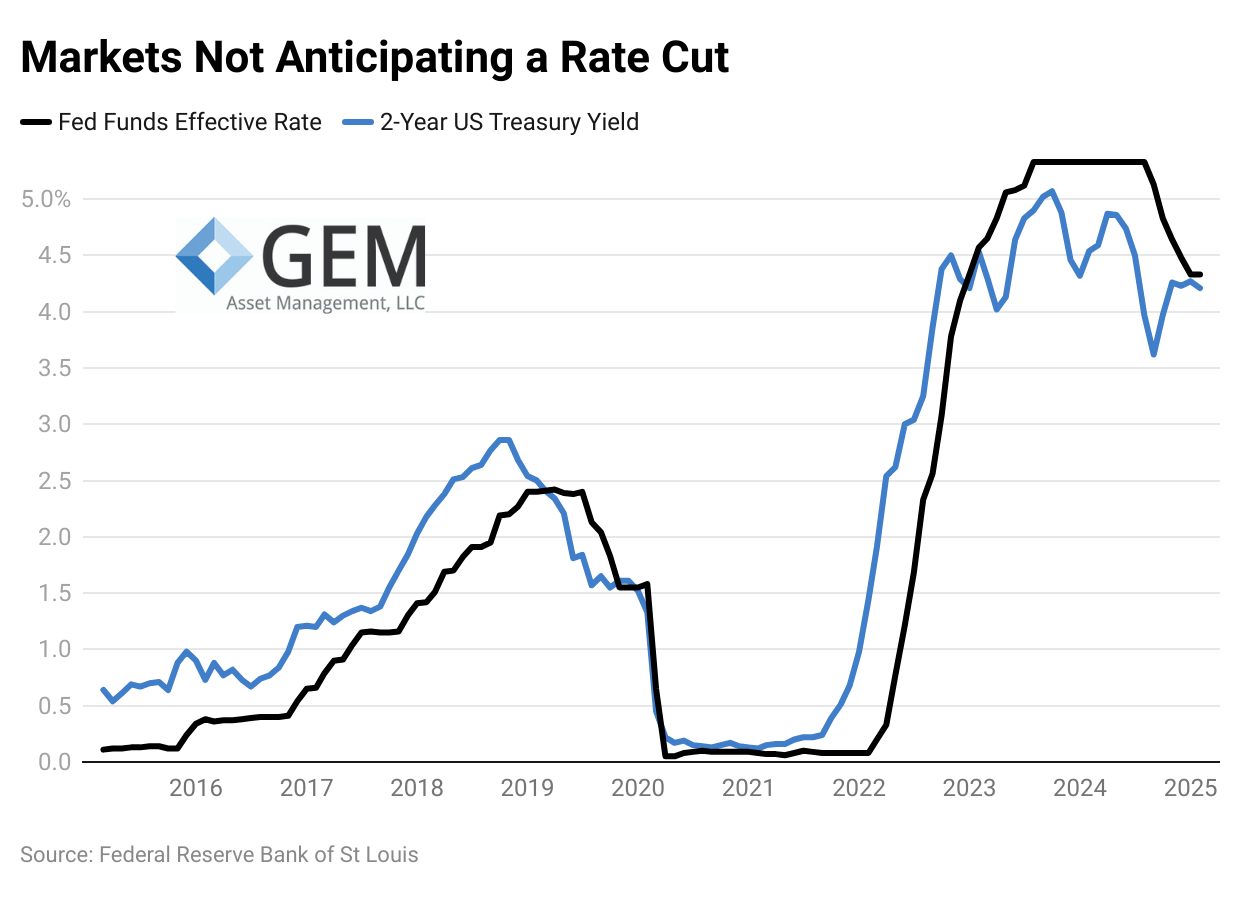

Fed Watching - A decline in interest rates and bond yields would help bond prices and overall investment returns. Investors watch the Federal Reserve for signs the central bank will cut their rates. Although the Fed has cut by 1% from its recent highs, it seems cautious to do more as inflation has been stubbornly anchored at around 3%.

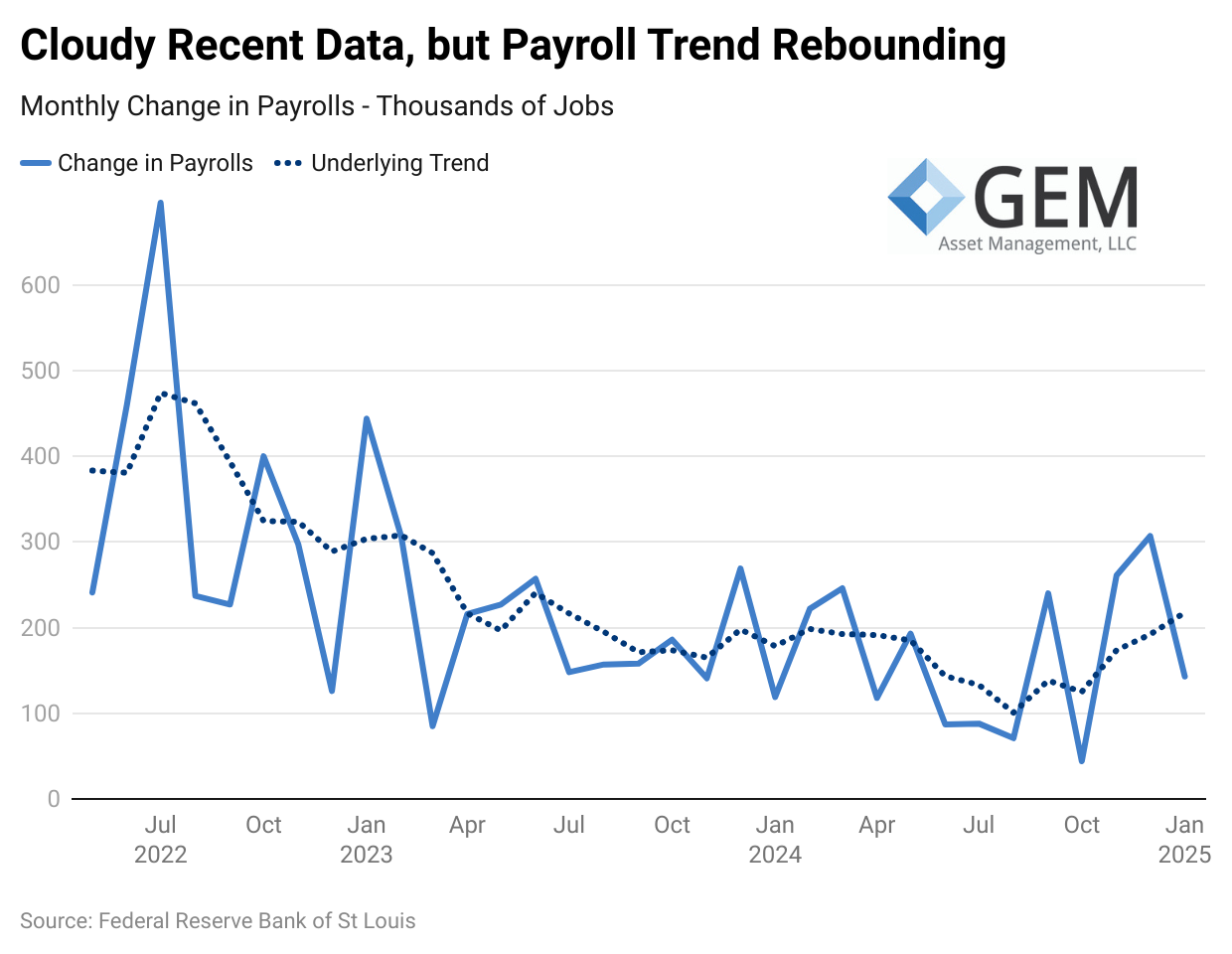

No Labor Pain - The most likely factor to cause Fed action on rates would be if the economy withered enough to affect employment. While the labor market has definitely cooled from the post-pandemic surge, payrolls growth has improved from the weakness seen last summer. Forecasts for GDP have been trending lower. A weaker economy may include deterioration in employment levels.

Holding Steady - The 2-year US Treasury is frequently a great indicator of where the bond market thinks or predicts the Federal Reserve will go with rates. At this time, it seems the market thinks the Fed will hold steady.