5 Key Items From Your Tax Return

It’s tax season. Beyond getting our returns completed and filed, many of us don’t give much them consideration beyond whether we’re getting a refund or not. Although tax filing has been simplified since the Tax Cuts and Jobs Act of 2017, there are still numerous opportunities for strategic tax planning. These items from the 1040 tax return are the basis for our discussions with clients in determining what strategies may be available to them.

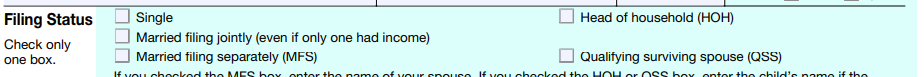

Filing Status — Not a number, but important in determining how you are taxed. Single, Married (jointly or separately), Head of Household, or Qualifying Surviving Spouse have different standard deductions and tables for computing taxes.

Line 7, Capital Gain or Loss — When investments are sold for an amount greater than their purchase price, it is a capital gain. If the investment was held for less than a year, the gain is taxed as ordinary income. Held longer than a year, the gain is taxed at a lower rate - either 0%, 15% or 20% depending on your filing status and taxable income.

Why It’s Important — The amount on this line is important to review when considering tax-loss harvesting opportunities in your investment portfolio. If this amount shows a $3,000 capital loss (the maximum loss that can be claimed) it may indicate an amount that is being carried forward and can offset future capital gains. This could minimize, or even eliminate, the tax impact of rebalancing a portfolio.

Line 12, Standard Deduction or Itemized — Deductions reduce the amount of income subject to tax. We find that after the 2017 tax changes, most taxpayers claim a standard deduction amount based on their filing status. However, some may have qualified deductions that exceed that amount and itemize them on Schedule A.

Why It’s Important — Itemized deductions are typically taken for mortgage interest, state and local taxes and medical expenses. Additionally, charitable gifts are also able to be itemized. Charitable giving offers several tax planning opportunities such as gifts of appreciated securities, donor advised funds and qualified charitable distributions. Additionally, some claiming a standard deduction may be able to bunch deductions into one year and reduce their taxable income.

Line 11, Adjusted Gross Income (AGI) — The total amount of income you received in the year including additional income and adjustments reported on Schedule 1. From this, your Modified Adjusted Gross Income (MAGI) is computed after adding back certain amounts that had been excluded from your income.

Why It’s important — This an essential number to determine your eligibility for many income- and tax-based benefits. The amount establishes if you can make contributions to certain retirement accounts and the deductibility of some contributions. It determines your eligibility for some healthcare benefits and the amounts charged for Medicare premiums. Some high-earners may be subject to certain taxes and surcharges based on their MAGI.

Line 15, Taxable Income — The number used to determine the amount of tax you owe to the government. Income taxes are charged at higher rates based on your income. Your taxable income amount determines what “tax bracket” you are in, or your marginal tax rate.

Why It’s important — This is how much each additional dollar of income is charged in taxes may help determine whether or not to invest in some tax-free securities such as municipal bonds. It can also be used to plan the timing of taxable distributions from retirement accounts.

Planning Opportunities - The tax code is very complex and presents many considerations for retaining more of the wealth and income you have earned. In addition to these items above, think about any expected changes in income such as job changes, income fluctuations or retirement.

Roth IRA conversions, Qualified Charitable Distributions, Donor Advised Funds, tax bracket management, tax-loss harvesting, retirement contributions and distributions,

estate and gift planning all present opportunities to manage and reduce your tax expenses.

Once you’ve noted these items from your return a GEM financial advisor can help you determine which opportunities may be available for you.